Uncertainties create a variety of possibilities for 2024, setting the stage for a year of cautious optimism in the oil and gas industry. But what does the future hold for oil demand in light of the recent “landmark agreement” driving the energy transition? How will this impact drilling activity in prolific regions like the Permian Basin and Haynesville Shale?

As the industry faces a complex financial landscape, we also explore the strategies of capital discipline among producers, the ongoing consolidation of E&P companies, and the broader implications of the energy transition. Read on to discover our top five takeaways for the year ahead.

Oil Demand

The immediate future of the oil market remains bright despite a recent worldwide agreement to ditch fossil fuels, but looking ahead, uncertainty clouds its long-term outlook.

In December, nearly 200 countries agreed at the COP28 climate summit to transition away from fossil fuels, which was hailed as a “historic deal” to accelerate climate action. Still, the implications of the COP28 agreement aren’t expected to affect oil demand much in the near term, according to the International Energy Agency (IEA).

Following the agreement, the IEA projected world oil consumption in 2024 would still rise by 1.1 million bpd, citing an improved economic outlook in the U.S. and lower oil prices. Long-term oil demand, however, remains uncertain due to many factors.

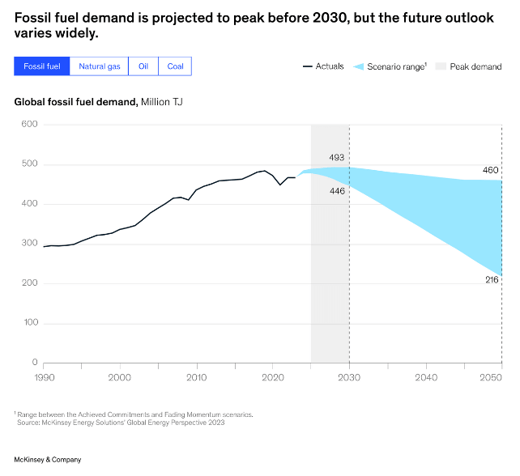

One major aspect clouding the long-term outlook for oil, according to a McKinsey & Co. report, is the growing push for an energy transition and the fossil fuels needed to complete the necessary renewable energy projects. Notably, supply chain disruptions, materials shortages, and production issues could slow the momentum of this transition away from fossil fuels during this period.

(Source: McKinsey & Co. Global Energy Perspectives)

The result, according to McKinsey, is a higher long-term demand growth forecast for oil than expected. Overall, the consulting firm believes oil demand will peak in 2030 and decline over the following 20 years, but noted the predicted rates of decline vary greatly.

Drilling Activity

Onshore drilling activity in the U.S. is set to remain steady in 2024, with a rosier outlook on the horizon due to increased takeaway capacity, particularly in the Permian Basin and Haynesville Shale.

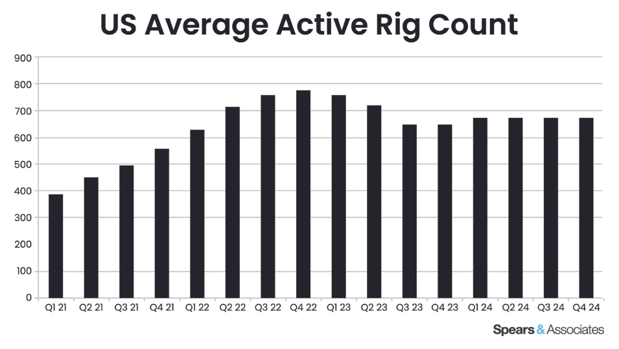

The period of stability experienced by the upstream sector in 2023 will likely continue into the New Year, a Westwood Global Energy Group analyst noted in a recent report. Analysts expect increased takeaway capacity from new LNG terminals and gas pipelines in key regions to boost the onshore rig count by 4%, but not until later this year.

(Source: Spears and Associates)

The Permian Basin will continue to be the main producer, accounting for 50% of all drilling activity in 2024, according to the report citing John Spears, President of Spears and Associates. However, the Permian isn’t expected to experience any major boost in drilling activity until two major pipelines - the Matterhorn Express Pipeline and Permian Pipeline Expansion - come online, which aren’t likely until the second half of 2024.

Similar to the Permian, drilling activity in the Haynesville Shale is forecast to remain in a holding pattern until several major midstream projects are completed. At that time, the Haynesville is projected to see a 10% increase in its rig count, which Spears said positions the play to take advantage of gas production hikes as gas prices recover.

Capital Discipline

The energy industry is entering 2024 in a strong financial position. However, it is expected to face increased scrutiny over emissions and economic performance. This comes amid a complex backdrop of fluctuating oil prices, uncertain market dynamics, and differing strategies among larger and smaller firms.

Optimism among oil companies is waning amid concerns about this uncertainty, according to a Dallas Federal Reserve Bank survey late last year. In the December issue of Short-Term Energy Outlook, the U.S. Energy Information Administration lowered its crude oil price forecasts for 2024, partly driven by recently announced OPEC+ production cuts. Still, analysts at the Deloitte Research Center for Energy & Industrials expect the industry to have a solid start to the New Year thanks to its shareholder-focused strategy and disciplined capital programs.

Overall, larger E&P companies are expected to focus on acquiring assets or reducing debt in the year ahead. Meanwhile, smaller E&P firms will aim to grow production. On the oilfield services side, Halliburton’s CEO predicted production costs to come down as drilling technology continues improving.

Industry Consolidation

Given the momentum from last year’s blockbuster upstream oil and gas deals, 2024 is poised to maintain that trend.

The latest Dallas Federal Reserve Bank survey anticipates more large mergers and acquisitions between E&P companies in 2024. This expectation seems on track, considering that, less than a month into the year, we’ve already witnessed the $7.4 billion merger agreement between Chesapeake Energy and Southwestern Energy.

This consolidation wave was marked by two major acquisitions announced weeks apart in the second half of 2023 - the acquisition of Pioneer Natural Resources by Exxon Mobil and Chevron’s purchase of Hess Corp. Ultimately, analysts at EY anticipate increased consolidation in the oil and gas industry, driven by a desire to boost operational efficiency and better manage capital and carbon. This could lead to a surge in large E&P companies opting to grow cash flow and returns through acquisitions, rather than pursuing traditional exploration methods.

Energy Transition

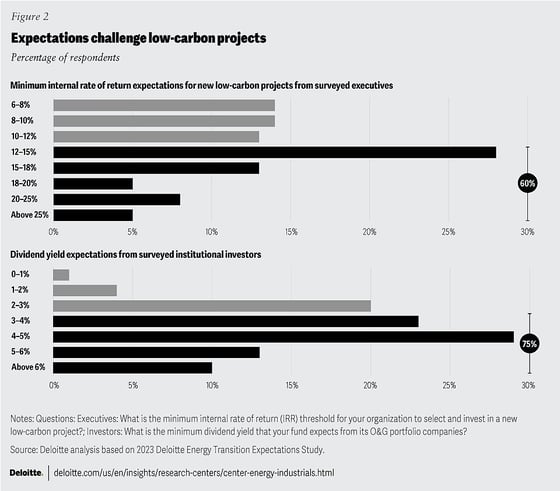

As the energy transition gains momentum, oil and gas companies are increasingly investing in low-carbon initiatives, though these investments are limited because they yield lower returns than traditional projects.

Investment in clean energy projects only accounts for 4% of upstream capex, according to a Deloitte report. When surveyed, oil and gas executives stated investment would be higher in low-carbon initiatives if the return exceeded 12% to 15%. Because returns typically run 6% to 8%, the report noted that oil and gas companies tend to directly invest in improving operational efficiencies and reducing direct emissions to meet energy transition metrics.

(Source: Deloitte Research Center for Energy & Industrials 2024 Oil and Gas Industry Outlook)

As a result, carbon capture, usage, and storage (CCUS) technology remains critical to low-carbon investment strategies and reaching climate goals. According to a McKinsey report, global investment in CCUS is estimated to reach between $100 billion and $400 billion by 2030.

Notably, Occidental Petroleum’s direct air capture (DAC) project in the Permian Basin, estimated to remove and capture 500,000 tons of carbon from the atmosphere annually, is expected to begin operations starting in 2024. Oxy is also working on the construction of a DAC facility on the King Ranch Lease in Kleberg County in South Texas.

The Road Ahead

Despite the global push for an energy transition, oil demand is not expected to decline as quickly as once thought. This reality leaves E&P companies planning for long-term investment. These strategies are essential to supply the energy needed to create infrastructure for sustainable energy.

As we navigate the challenges and opportunities presented by the energy transition, the oil market’s resilience and the stability in drilling activity underscore the industry’s adaptability. At The Panther Companies, we remain at the forefront of this evolution

Navigate the Future with the Big Cats

Panther is committed to providing innovative solutions in drilling fluids, solids control equipment, haul-off, and disposal services. Our engineering expertise uniquely positions us to support E&P companies in their journey toward their sustainability goals.

Contact a Panther team member today to discover how our comprehensive wellsite programs can optimize your operations and maximize your return on investment in this rapidly changing landscape.